3 Possible Events That Could Trigger A Meaningful Stock Market Top

Almost everyday on TV we hear one person or another calling for a major market top. While most of these forecasts have not worked out very well there will be a time when the stock market does top out and stage a meaningful decline. Listed below are three potential problems that could lead to a meaningful stock market top and a real correction of 20 percent or more.

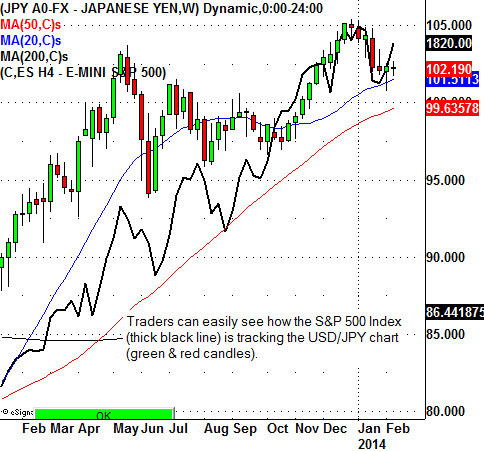

1. The currency market holds all of the cards. At this time, the most important currency pair to follow is the USD/JPY (U.S. Dollar verse the Japanese Yen). Obviously, when the USD/JPY chart declines it means the Japanese Yen is strengthening against the U.S. Dollar. When this happens liquidity comes out of the stock market. The reason that this happens is because the highly leveraged institutional traders are all betting on a weaker Japanese yen, so when the USD/JPY chart declines the institutions lose buying power and can no longer support stocks in the United States, Europe, and Japan. Recently, countries such as Turkey, South Africa, and India have raised interest rates to try and strengthen their currency against the U.S. Dollar for fear of a currency crisis. This could repeat again this year, so keep your eyes open for more currency problems around the world.

2. China has faced a lot of problems regarding their shadow banking system. Shadow banking is unregulated high-yield lending that largely takes place off banks’ balance sheets in China. This problem is very similar to the U.S. sub-prime crisis back in 2007. This shadow banking problem has not been solved yet despite the efforts by the Chinese central bank. This is certainly an issue that could trouble the Chinese economy in 2014.

3. Traders and investors must watch for potential conflict between Japan and China. Last year, both countries claimed ownership of a group of islands in the East China Sea. Leaders from both countries have recently mentioned that the relationship between the two countries is very poor. It is also important to remember that China is the second largest economy in the world. China also holds a lot of U.S. debt. Japan is the third largest economy in the world behind China so any conflict would result in serious problems for the global economy.

Disclosure: This article is written by Nicholas Santiago. Nicholas Santiago is a co-founder of In The Money Stocks. Nicholas Santiago and In The Money Stocks represent that Nicholas Santiago does own physical gold and silver at the time the article was submitted.