Don’t Buy Gold Until These 3 Things Happen

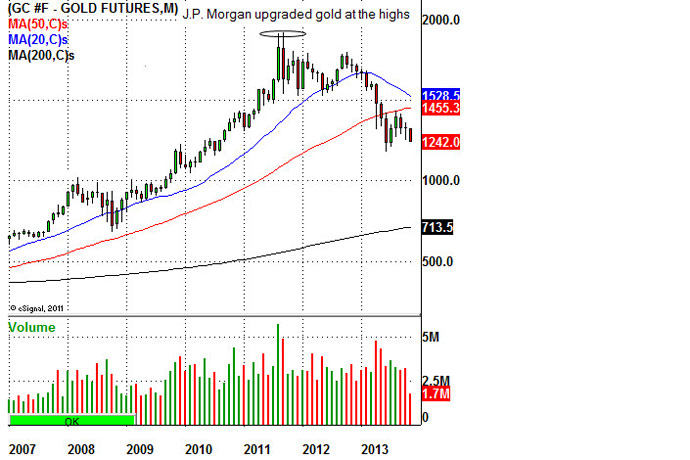

Almost every trading day someone asks me if they should buy gold. Personally, I own physical gold and silver bullion since 2004, but if you are trading gold ETFs, you may want to wait before jumping on board at this time. As you all know, gold topped out in September 2011 at $1923.70 an ounce. Ironically, that same week that gold topped out it was upgraded by J.P. Morgan Chase (NYSE:JPM) to $2500.00 an ounce. Either J.P. Morgan Chase is just terrible at spotting tops or it was looking to sell to the amateurs that always buy the peak. My suspicion is the latter as most large firms have an agenda behind their upgrades and downgrades when equities are at extreme highs and lows. Just think about it, Goldman Sachs (NYSE:GS) upgraded oil to $250.00 a barrel when it was trading at $145.00 a barrel in July 2008. As you probably know, oil peaked at $147.00 a barrel a week after that upgrade. Again, the amateurs that followed that upgrade were just decimated when oil was bought at that high. Oil dropped to $30.00 over the next year. Now gold has turned into one of the most hated commodities out there by Wall Street. Currently, gold is coming under pressure due to potential tightening of the Federal Reserve’s $85 billion QE-3 program. Now let us be clear, the Federal Reserve has not begun to tapper yet, it is only floating rumors of a tapering. This can be seen by the recent rise in yields in the 10-year U.S. Treasury Note yield. So enough with that, here are three signs to look for that will tell us we should buy gold ETF’s again:

1. If the recent low in gold futures (GC) from June 28, 2013 is briefly broken to the downside and then reverses back to the upside on volume. If this occurs it will signal institutional sponsorship and it will most likely be a solid low in place. This could also lead to a W-bottom pattern on the larger time frame which often signals huge upside potential.

2. Next, watch for a major downgrade from Goldman Sachs, J.P. Morgan Chase & Co or another major firm. Remember, when these giant firms downgrade stocks at lows it is often a sign that they now want to own that equity. Just look ay their past track records of upgrading and downgrading stocks at extreme highs and lows.

3. Gold is a currency, this is why central banks around the world own it, and this includes the Federal Reserve. So when you start to notice that asset prices are falling despite the easy money policies (money printing) by the central banks around the globe it is a good time to get on board and own some gold. After all, gold cannot be printed out of thin air or by a click of a keyboard like the fiat monetary system that we have today. Why do you think Bitcoin is becoming so popular right now? Bitcoin only has a certain amount available for use unlike fiat currency which can be printed infinitely.

Disclosure: This article is written by Nicolas Santiago. Nicholas Santiago is a co-founder of In The Money Stocks. Nicholas Santiago and In The Money Stocks represent that Nicolas Santiago does own physical gold and silver at the time the article was submitted.