Expect A Higher Debt Ceiling From A System Built On Debt

Image via Flickr/ Joe Mazzola

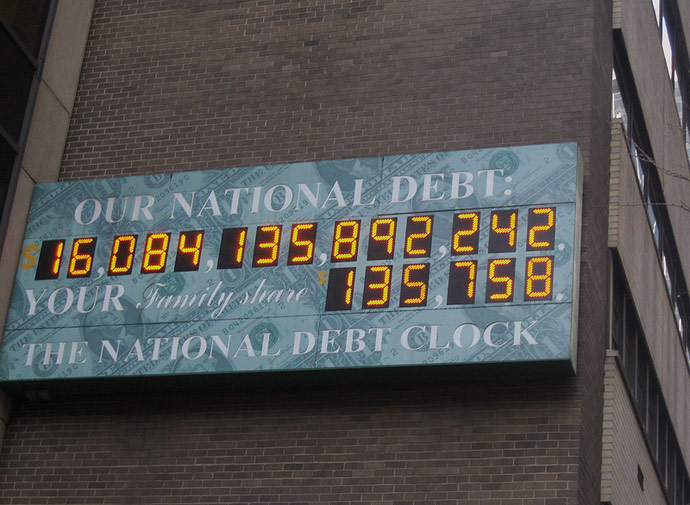

Everyday we hear about the current government shutdown and the upcoming debt ceiling being reached by the U.S. government. The debt ceiling is the legal limit on the amount of money that the government is allowed to borrow in order to keep the government functioning. Why does the government have to borrow money to keep itself running? It is telling us that the government is spending money it does not have. A company or a household could not operate in this manner, they would have to file bankruptcy. Just look at companies such as J. C. Penney Company, Inc. (NYSE:JCP), and BlackBerry Limited (NASDAQ:BBRY); these two companies are cash strapped and possibly facing bankruptcy very soon. They cannot print money to stay in business, and if they do receive cash from a lender they are expected to pay it back in a specified amount of time. The government does not work this way.

The current global economic system is a system of credit and debt. Marriner Stoddard Eccles was the former chairman of the Federal Reserve from 1934 – 1948. He stated, the United States economy is like a poker game where the chips have become concentrated in fewer and fewer hands, and where the other fellows can stay in the game only by borrowing. When their credit runs out, the game will stop. So this tells us that the United States will always have to raise the debt ceiling regardless who the president is. Since 1980, the U.S. Debt ceiling has been raised over 40 times, so what is the point of having a debt ceiling?

The bottom line, all Presidents raise the debt ceiling. Ronald Reagan tripled the national debt while he was in office. Bill Clinton raised the debt ceiling eight times while he was the President. George W. Bush raised it seven times. Meanwhile, President Obama has raised it three times. In fact, every President since Herbert Hoover has added to the national debt. It has really been a long time since the United States had an Andrew Jackson in office. In fact, Andrew Jackson was the only U.S. President that ever paid off the entire U.S. Debt, this was in 1835. Unfortunately for President Jackson, a severe depression occurred in 1837 that cause the debt to spike to $3.3 million in 1838. Today, the national debt is around $17 trillion, that is sure a lot higher than $3.3 million.

This government debt is just a by-product of the fiat money system that we live in. It will always need to be raised especially during difficult and troubled times. The United States Treasury has to borrow more and more money to pay for its obligations. Eventually, there will be a day when the market realizes that the debt can never be paid back, but that could still be a long time from now. Either way, we should all expect a higher debt ceiling because our entire economic system is built on debt.

Disclosure: This article is written by Nicolas Santiago. Nicholas Santiago is a co-founder of In The Money Stocks. Nicholas Santiago and In The Money Stocks have no position in any stocks mentioned in this article, and does not intend to initiate any position in the next 48 hours.