11 Money Moves For Life Post-Vaccine You Need To Look At

It’s our mission to make money matters a little less insane. We provide financial editorial content free for all and are supported by affiliate partners included in this post which earns us a commission. We hope you enjoy our content and subscribe to our newsletter.

The COVID-19 pandemic has had a drastic impact on the physical, mental, and financial wellbeing of so many. But now, with a vaccine being well and truly circulated throughout the country, many people are anticipating that things will return to at least some sense of normality.

With the vaccine, you might be a little more hopeful than you were yesterday. Now is as good a time as ever to look optimistically toward the future and make smart financial decisions for you and your family.

Here are 11 money moves you can make during life post-vaccine.

1. Give Your Family Up to $1.5 Million

christian buehner on Unsplash

The coronavirus pandemic has reminded us all of our own mortality. If you were to pass unexpectedly, would your family have enough money to pay the bills?

You might assume that you have enough money in savings. But while savings is important, you might be underestimating just how much money is needed. With a life insurance policy that leaves your family with up to $1.5 million, however, you could rest assured that they would have enough.

With Bestow, you can get coverage between $50,000 and $1,500,000, and policies start at just $16 a month.

And get this — because life insurance is typically cheaper when you’re young, you can lock in your rate today and enjoy the same low premium as you grow older and your health starts to decline.

What’s more, Bestow makes it easy to get life insurance. Without filling out paperwork or leaving your couch, you can get a free quote from Bestow in seconds. As the company uses non-commissioned agents, you can get the assistance you need without fear of being upsold or hassled!

2. Switch to a Cheaper Auto Insurance Policy

Joey Banks on Unsplash

There were many people who put fewer miles on their cars last year, largely due to the pandemic. But regardless of whether you drove less, more, or roughly the same as last year, you’re probably still overpaying for car insurance.

EverQuote is an insurance comparison site that takes the pain out of shopping for a new policy. Simply provide a few details about your vehicle and the site will actually do the shopping for you — finding you multiple rates in just two minutes.

Finding a cheaper policy could potentially save you hundreds of dollars each year on car insurance.

Find out how much you could save by shopping with EverQuote today!

3. Potentially Save Thousands of Dollars on Your House

Pixabay on Pexels

Your home is probably your largest investment and your largest opportunity to save money. Even cutting your interest rate by 1% could result in thousands of dollars back in your pocket!

By refinancing, you might be able to do just that. Refinancing is the process of replacing your current home loan with a new loan that, ideally, has a lower interest rate and better terms.

Sound easy? With Figure, it is. This online lender will let you check your rates in only a few clicks and this won’t even affect your credit score!

Using Figure’s 100% application form, you can apply for a loan quickly; and once approved, the company will help you close it out so that you can start saving right away.

Check your mortgage refinance rates with Figure today and see just how much you could be saving on your house!

Currently, Figure is only available in AK, AL, AR, AZ, CA, DE, FL, GA, IA, ID, IN, KS, LA, MA, MI, MO, MS, MT, NC, ND, NE, NH, NJ, NM, NV, OH, OK, OR, PA, SD, TN, WA, WI, and WV.

4. You Could Switch to a Cheaper Homeowners or Renters Insurance Policy in Minutes

Sidekix Media on Unsplash

When was the last time you checked your homeowners or renters insurance rates? For many people, there are cheaper rates floating around but they just don’t know where to look.

With EverQuote, you can get multiple quotes at once with very little effort. Here’s how it works — you provide a few details about your home and this insurance comparison site will find rates from various companies for you to compare.

This service is free to use and could help you make the switch to a cheaper policy in minutes.

Try EverQuote today and find out how much you could be saving on homeowners or renters insurance!

5. Business Owners, You Could Get a Free $300 Advertising Credit to Reach New Customers

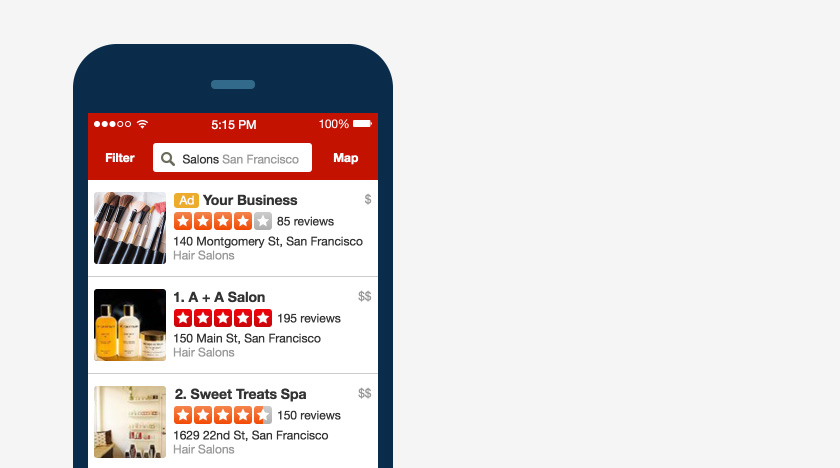

Yelp

Finding new customers isn’t easy. But maybe you’re making it harder than it needs to be by searching in all of the wrong places.

Instead, consider that many potential customers might already be looking for you —online.

Yelp is one of the largest online directories in the world, and millions of customers use the platform each month to search for restaurants, home services, healthcare providers, and all kinds of businesses.

When your business signs up with Yelp, not only will you be able to reach more customers online but you’ll also get a free $300 advertising credit to start!

Over 29 million businesses, including many of your direct competitors, are already using Yelp to find new customers. Keep up with them and even get ahead of the competition by advertising on the platform.

Sign up with Yelp today, get your free $300 advertising credit while this offer lasts, and start finding more customers for your business!

6. Diversify Your Investments With Art

Vlad Kutepov on Unsplash

We all witnessed how the stock market was impacted due to the pandemic. This was yet another reminder that it’s wise to diversify your investments — looking beyond just the stock market and finding other ways to potentially grow wealth.

For years, blue-chip artwork was a market — one that, according to ArtPrice, outperformed the S&P by over 250% from 2000 – 2018 — that only the ultra-rich could invest in.

Masterworks makes it so that anyone can invest in a portfolio of top-tier art pieces that have been curated by the company’s research professionals.

Once you invest, you can wait for Masterworks to sell the art over the next 3 – 10 years, or you can opt to sell your shares on the platform’s secondary market.

For a small management fee, you’ll get professional storage, insurance, and administrative costs covered, plus more!

Request your invite for membership with Masterworks today to start investing!

7. You Could Leave Your Family Up to $8 Million

Jimmy Dean on Unsplash

At your age, life insurance may not be at the top of your mind. Maybe you’re even banking on your savings to provide for your family if something were to happen to you. But in reality, your savings probably only scratches the surface of what is needed.

This is why life insurance is so important, at any stage of life! But here’s where it’s critical for someone your age to get life insurance — the older you get, the more costly life insurance becomes. So, there’s no better time than today to get a policy.

And with Ladder, it’s easy. All you need is a few minutes to complete the company’s application form, and you won’t even need to provide a medical exam or fill out physical paperwork.

Plans start at just $12 a month — a price that most people can afford. Plus, Ladder offers coverage up to $8 million. That’s more than enough to make sure your family is taken care of if you were to pass unexpectedly.

Your premium might be higher tomorrow, so don’t wait to get life insurance. Apply for Ladder life insurance todayand find out how affordable life insurance can be.

8. You Could Use Your Home to Get Access to Up to $250,000

Rowan Heuvel on Unsplash

Being a homeowner has its perks. One of the more overlooked opportunities is the ability to get access to money that can be used for all sorts of purposes — fixing up your home, paying medical bills, or funding a family vacation!

That’s exactly what you get with a HELOC (home equity line of credit). A HELOC is a low-interest loan that uses the equity in your home as collateral.

Figure is an online lender that could help you get up to $250,000 against the equity in your home.

Plus, they make the process incredibly easy. Their application is 100% online application and it takes only 5 minutes to fill out. If you’re approved, you could get your funds in as little as five days!

Learn more about Figure and how your can use your status as a homeowner to get the money you need!

9. You Could Get Free Credit Monitoring with This Company

Shutterstock

Whenever you need to borrow money, your credit score typically impacts how much you’re able to borrow and the interest rate you’re able to get.

So, the higher your credit score, the better. And regardless of how old you are, you can always take steps to improve it.

Credit Sesame is a site that equips you with all sorts of important tools to help you on your journey towards better credit. They give you credit score monitoring, product recommendations, ID theft protection, and much more — and it’s free to use!

More than eight million people are currently using Credit Sesame to improve their credit scores. You can, too. Simply take 90 seconds to create an account.

Sign up for Credit Sesame today and raise that score!

10. You Could Save Up to $1,000 with This Simple App

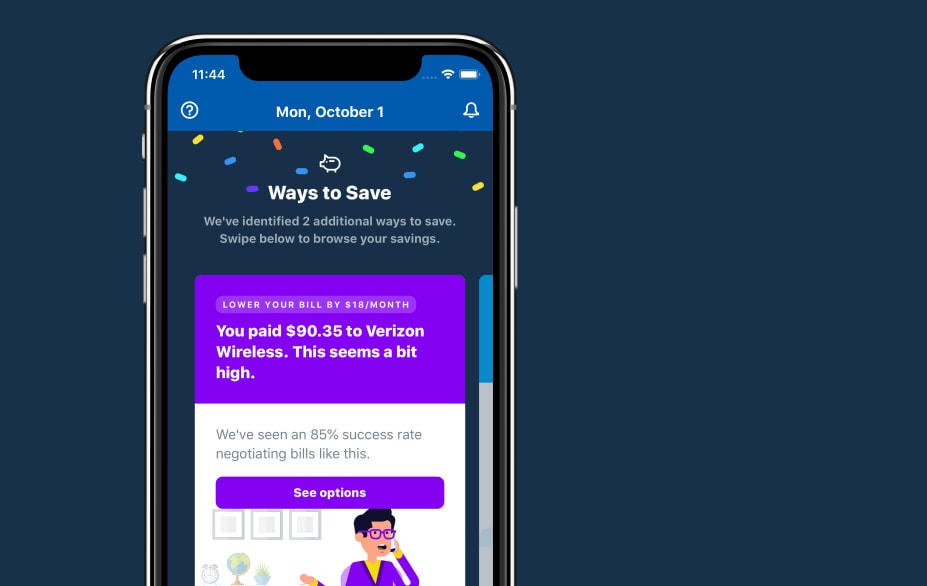

Truebill

At your age, you’re no stranger to the bills and expenses coming out of your checking account each month. But that doesn’t mean it’s easy to track all of these items.

Truebill could help you out in a huge way. This app shows you all of your expenses in one place, and with your permission, will actually cancel the ones you don’t want!

But that’s not all. Truebill even negotiates bills for you. Rather than spending hours on the phone arguing over your cable bills, phone bills, and more, Truebill will do the heavy lifting for you — working to negotiate better rates so that you’re saving both time and money every month.

All in all, these changes could quickly save you up to $1,000 a year. All you have to do is download the Truebill app today!

11. You Could Potentially Save Thousands on Your Student Loans with This Site

Pixabay on Pexels

Tired of being in student loan debt at this point in your life? You could potentially get out of debt faster and pay less in interest fees simply by refinancing your student loans.

Refinancing is the process is replacing one or more loans with a new loan that, ideally, has a lower interest rate and better terms.

And with Credible, you could refinance your student loans quickly and potentially save thousands of dollars.

It’s easy to get started. Simply fill out the site’s online form, and in 2 minutes, they will show you up to 11 student loan refinance offers in one place. And get this — this check won’t even affect your credit score!

When you apply, approved, and close out your new loan, you’ll even get a welcome bonus of up to $300. Check your student loan refinance rates with Credible today to get started!

Inject Your Finances with a Few Smart Money Moves

With much of the pandemic’s financial impact in the rearview, you can finally start looking toward the future again.

Rather than being preoccupied with your financial health in the here-and-now, you can start making money moves that will impact your life 10, 20, and 30 years from now!

*Wall Street Insanity is a paid affiliate/partner of Stash. Promotion is subject to Terms and Conditions. To be eligible to participate in this Promotion and receive the bonus, you must complete the following steps: (i) click through the link above, (ii) successfully open a Stash Invest Account (otherwise known as your personal portfolio) in good standing, (iii) link a funding account (e.g. an external bank account) to your new Stash Invest Account, AND (iv) initiate and complete a deposit of at least five dollars ($5.00) into your Stash Invest Account.

(*1)Bank Account Services provided by Green Dot Bank, Member FDIC

(*2)Stash banking account opening is subject to identity verification by Green Dot Bank. In order for a user to be eligible for a Stash banking account, they must also have opened a taxable brokerage account on Stash. Bank Account Services provided by Green Dot Bank and Stash Visa Debit card (Stock-Back® Card) issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Investment products and services provided by Stash Investments LLC, not Green Dot Bank, and are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value.